The miraculous metal “Lithium-Ion” that might complicate India’s plans for EVs.

During FY20–FY22, domestic sales of EVs in India increased at a CAGR of 205% for two-wheelers and 149% for four-wheelers, respectively. However, ongoing worries about the availability of raw materials especially “Lithium-ion” are expected to impact demand in the years to come.

The recent growth can be attributed to a low starting point, rising demand, and government initiatives to support that demand. While Lithium-Ion battery production costs have decreased over the previous few years, CareEdge stated in its analysis that they are unlikely to decrease from present levels for the next three years, somewhat reducing demand for EVs.

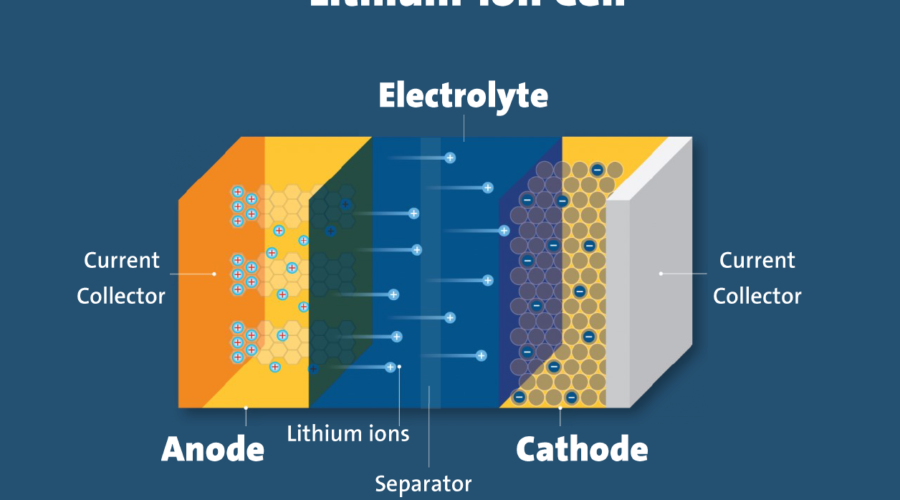

Lithium, cobalt, and nickel are the three main raw elements required for the production of cathodes. The research states that there has been an imbalance between demand and supply for certain metals over the past five years as a result of rising demand.

Lithium, cobalt, and nickel are the three main raw elements required for the production of cathodes. The research states that there has been an imbalance between demand and supply for certain metals over the past five years as a result of rising demand.

Due to a number of factors, including the Russia-Ukraine war and activism against the negative environmental effects of these metals’ extraction, the prices of these essential metals have been fluctuating over the past few months.

According to market statistics, CareEdge predicted that it would take at least three years to increase mining capacity for lithium, cobalt, and nickel. In the meantime, the company predicted that battery prices would hold steady at current levels.